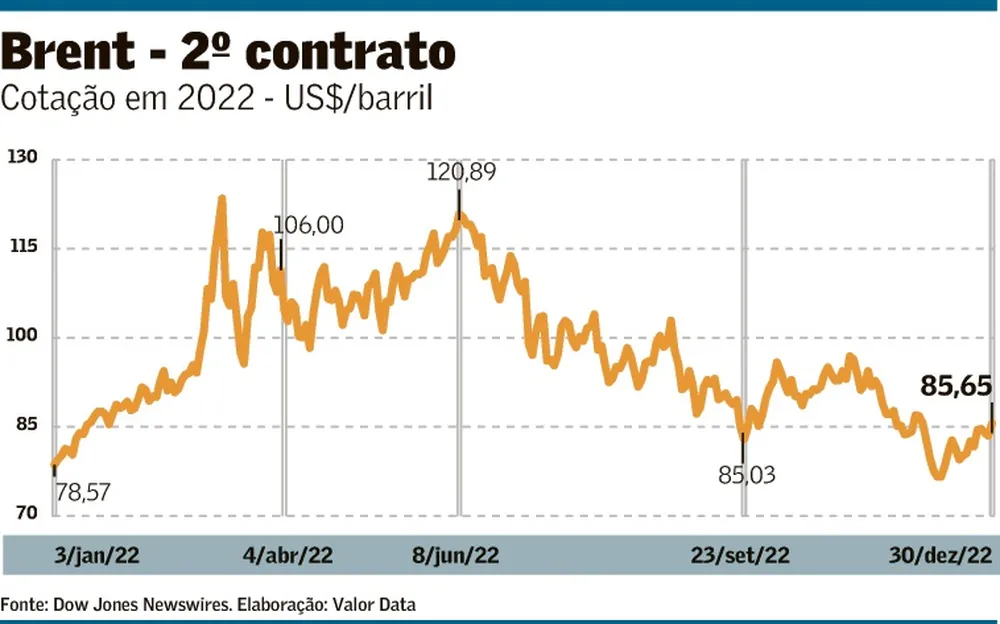

Even if the war between Russia and Ukraine ended today, the effects of the ten-month conflict would still linger on the global oil market for a few more years. And price volatility in 2022 is expected to continue into next year, according to experts interviewed by Valor. The barrel closed the year at US$85.65, not much higher than the US$78.57 recorded at the close of the first day of the year. The average price of the barrel in 2022 was US$97.20, up 38.05% compared to US$70.41 in 2021, according to Valor Data.

The Russians’ cut in the supply of derivatives to Europe, in response to the announced sanctions that come into effect in February, has tightened and reshaped the market worldwide and brought the issue of energy security to the fore, equaling in importance to the ESG agenda.

A possible recession in Europe and the United States and uncertainty about China’s policy to combat COVID-19 also affected the variation in Brent. In Brazil, the result was an increase in fuel prices, linked to the international market. Starting in March, Brent surpassed the US$100 barrier and remained in that range until the end of August, when it began to fall to a range between US$80 and US$90. Natural gas reached US$70 per million BTU (MMBTU) – the standard unit of measurement for the product – but prices fell back to pre-pandemic levels, according to Refinitiv. Before the war, Brent prices were on an upward trend, with the recovery of the global economy after the pandemic. However, the conflict boosted prices and changed trade flows for oil and derivatives. Countries were forced to diversify their energy sources, including the return of nuclear generation and coal, which had been neglected in recent years. “[The year] 2022 was the year in which the most coal was consumed in the world for power generation, especially because of Europe, despite all the efforts of the ESG banner”, highlighted consultant Eduardo Antonello, former president of Golar Power. He recalls that the United States released more than 600 million barrels of oil from stocks in an attempt to contain the rise in prices.

For much of the year, global demand for fuels was strong, but it fell in the last months of 2022. According to a recent report by consultancy HedgePoint, there are signs that the initial shortage is beginning to weaken, with a gradual increase in stocks. However, it is important to note that diesel stocks are still not at a healthy level at global levels, points out the consultancy. “Even so, there is an improvement happening, while the feeling of lack of supply, on the part of traders, is beginning to diminish”, said Hedgepoint. Wood Mackenzie also sees pressure on demand for diesel in 2023, as Russia is the main supplier of the fuel to Europe, which, like Brazil, has a high demand for the product. On the other hand, the consultancy highlighted that demand for natural gas in Europe fell by 10% in 2022 and should close the winter with 38% of storage, making it possible to reach the 90% inventory target by November. Marcelo de Assis, Wood Mackenzie’s director of upstream research (exploration and production), said that the winter is not as harsh as expected, with less demand for heating, which rules out the prospect of an increase in demand between January and February. “We do not foresee consumption above the average,” said Assis.

In the view of Marcus D’Elia, partner at Leggio Consultoria, an immediate solution in the face of a tight scenario is to seek alternative supply chains, such as India and the Middle East. For him, the ideal is for this solution to be adopted in advance, to test which contracting model works well. “This is something that companies should do, not government action,” said D’Elia.

For Décio Oddone, president of Enauta and former general director of the National Agency of Petroleum, Natural Gas and Biofuels (ANP), volatility is likely to continue for quite some time, due to uncertainties both on the supply side, with the reduction in supply from Russia, and on the demand side, due to the effects of an economic recession that could pull energy consumption down in major economies.

The executive estimates that Brent prices should remain in the range of US$ 80 in 2023. D’Elia, from Leggio, highlighted that international projections have been pointing to prices at this level next year, between US$ 80 and US$ 100. Luiz Carvalho, senior oil and gas analyst at UBS BB, projects US$ 95 per barrel. Assis, from Wood Mackenzie, estimates an average of US$ 90, considering the current stage of the war, without major developments.

In Brazil, fuel prices jumped in the first half of 2022, especially diesel and LPG, products whose imports meet about a quarter of their respective demands. A combination of changes in Petrobras’ presidents promoted by President Jair Bolsonaro, reduction of taxes on fuels and a drop in international prices from July onwards led to a decline in domestic prices of derivatives. Part of this drop should be reversed, however, in 2023, with the end of the PIS/Cofins tax exemption on fuels, if the government chooses not to extend the federal tax cut.

The government of Luiz Inácio Lula da Silva has widely signaled its intention to change the fuel pricing policy. Currently, Petrobras, the country’s main refiner, adopts the Import Parity Price (PPI), which also considers parameters such as the exchange rate in the calculation. The company’s future president, Jean-Paul Prates, has stated that the fuel pricing policy is a matter for the government, and not just for a market company.

According to Oddone, it is inevitable to associate fuel prices in the country with the foreign market, at the risk of shortages if prices remain above parity. And there is a risk of discouraging investments in the production of derivatives if domestic prices remain below the PPI.

Assis, from Wood Mackenzie, noted that fuel prices also depend on factors such as the conduct of fiscal and economic policies, which impact the dollar exchange rate (PPI variable). Another uncertainty is the implementation of the idea of nationalizing refined product prices, leaving the PPI aside. “There are several factors that are not associated only with the foreign market,” concluded Assis.

Source: Jornal – Valor Econômico