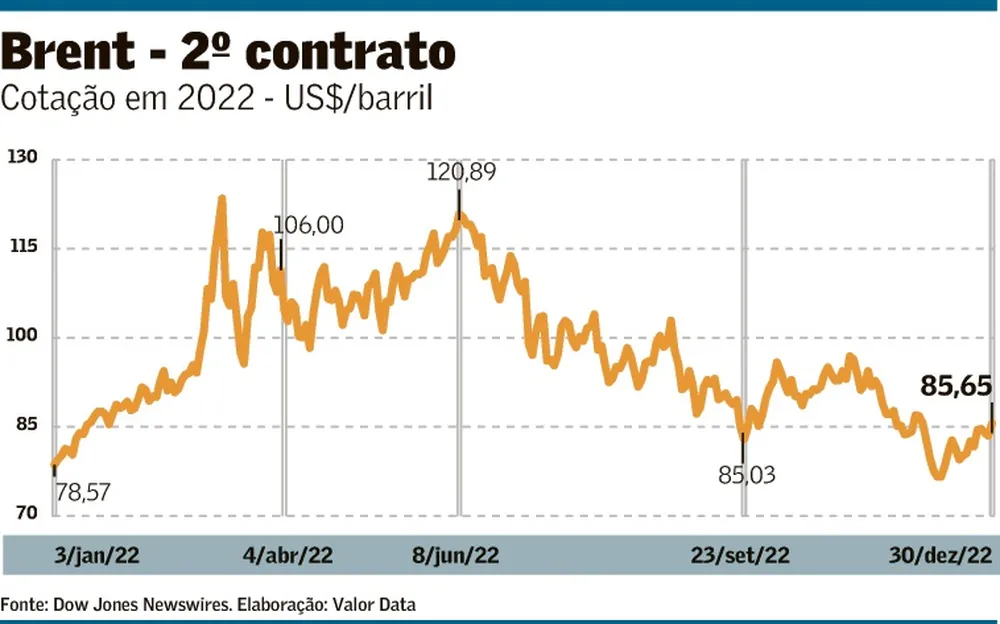

Even if the war between Russia and Ukraine ended today, the effects of the ten-month conflict would still linger on the global oil market for a few more years. And the volatility of prices in 2022 should continue next year, according to specialists interviewed by the Value. The barrel closed the year quoted at US$ 85.65, not much above the US$ 78.57 recorded at the close of the first day of the year. The average price per barrel in 2022 was US$ 97.20, up from 38.05% against US$ 70.41 in 2021, according to the Value Date.

The cut, by the Russians, of the supply of derivatives to Europe, in response to the announced sanctions that come into force in February, tightened and redesigned the market in the world and brought to the fore the issue of energy security, equaling in importance to the of the ESG agenda.

A possible recession in Europe and the United States and uncertainty about the policy to combat covid-19 in China also reflected in the variation of Brent. In Brazil, the consequence was increases in fuel prices, linked to the international market. As of March, Brent surpassed the barrier of US$ 100, remaining in that range until the end of August, when it began to retreat to a range between US$ 80 and US$ 90. Natural gas reached US$ 70 per million BTU ( MMBTU) – the product's standard unit of measure, but prices have retreated to pre-pandemic levels, according to Refinitiv.

Before the war, the price of Brent followed an upward trend, with the recovery of the post-pandemic global economy. However, the conflict boosted values and altered trade flows for oil and derivatives. Countries were forced to diversify energy sources, including the return of nuclear generation and mineral coal, which had been left aside in recent years. “[The year] 2022 was the year in which coal was consumed the most in the world for power generation, especially in Europe, despite all the efforts of the ESG flag”, highlighted consultant Eduardo Antonello, former president of Golar Power. He recalls that the United States released more than 600 million barrels of oil from stocks in an attempt to contain the rise in prices.

For most of the year, world demand for fuels was heated, but dropped in the last months of 2022. According to a recent report by the consultancy HedgePoint, there are indications that the initial shortage is beginning to weaken, with a gradual increase in stocks. However, attention should be paid to the fact that diesel stocks are still not at a healthy level at global levels, points out the consultancy. “Even so, there is an improvement taking place, as the sense of lack of supply on the part of traders begins to subside,” said Hedgepoint.

Wood Mackenzie also sees the demand for diesel under pressure in 2023, as Russia is the main supplier of the fuel to Europe, which, like Brazil, has high demand for the product. On the other hand, the consultancy highlighted that the demand for natural gas in Europe reduced by 10% in 2022 and should close the winter with 38% of storage, making it possible to reach the stock target of 90% by November. Marcelo de Assis, director of research in upstream (exploration and production) at Wood Mackenzie, said that the winter is not as severe as expected, with less demand for heating, which removes the prospect of an increase in demand between January and February. "We do not foresee consumption outside the average," said Assis.

In the view of Marcus D'Elia, a partner at Leggio Consultoria, an immediate way out in the face of a tight scenario is the search for alternative supply chains, such as India and the Middle East. For him, the ideal is that this solution be adopted in advance, to test which hiring model works well. “This is up to the companies to do, it's not a government action,” said D'Elia.

For Décio Oddone, president of Enauta and former director general of the National Agency of Petroleum, Natural Gas and Biofuels (ANP), volatility should last for a long time, due to uncertainties both on the supply side, with the reduction on the supply side by Russia, as well as on the demand side, because of the effects of an economic recession that could pull down energy consumption in the major economies.

The executive estimates that Brent prices should remain in the US$ 80 range in 2023. D'Elia, from Leggio, pointed out that international projections have been pointing to prices at this level next year, between US$ 80 and US$ 100. Luiz Carvalho, analyst oil and gas senior at UBS BB, projects US$ 95 a barrel. Assis, from Wood Mackenzie, estimates an average of US$ 90, considering the current stage of the war, without major evolutions.

In Brazil, fuel prices jumped in the first half of 2022, especially diesel oil and LPG, products whose importation meets about a quarter of the respective demands. A combination of changes in Petrobras presidents promoted by President Jair Bolsonaro, a reduction in fuel taxes and a drop in international prices as of July led to a decline in domestic oil prices. Part of this drop should be reversed, however, in 2023, with the end of the PIS/Cofins exemption on fuels, if the government chooses not to extend the federal tax cut.

Luiz Inácio Lula da Silva's government has widely signaled its intention to change the fuel price policy. Currently, Petrobras, the main refiner in the country, adopts the Import Parity Price (PPI), which also considers parameters such as the exchange rate in the calculation. The company's future president, Jean-Paul Prates, has stated that the fuel price policy is a matter for the government, and not just for a market company.

According to Oddone, it is inexorable to link fuel prices in the country to the foreign market, under the risk of shortages, if prices are maintained above par. And there is a risk of discouraging investments in the production of derivatives if domestic prices remain below the PPI.

Assis, from Wood Mackenzie, recalled that fuel prices also depend on points such as the conduct of fiscal and economic policies, which impact the dollar exchange rate (PPI variable). Another uncertainty is the implementation of the idea of nationalizing the prices of refined products, leaving the PPI aside. “There are several factors that are not associated only with the foreign market”, concludes Assis.